Gabbi knew that real estate was the right career from the start. She is now dual licensed in both Kentucky and Ohio. She had her first sale within a month of getting licensed and hit her first million in volume within her first 6 months. She will have her real estate license for the rest of her life. Call her anytime if you have questions about becoming a real estate agent. She loves to share her passion for real estate with others!

- Get a License

-

Post-License

Post-License Courses

- Reciprocity

- Managing Broker

- CE

- Exam Prep

- Get a License

-

Post-License

Post-License Courses

- Reciprocity

- Managing Broker

- CE

- Exam Prep

Investing in Rental Property For Beginners

A rental property investment can be a savvy way to get involved in real estate. So, let’s talk about investment properties. Within the past year, my mother has purchased two investment properties, so this has been a huge interest of mine. I’ve been reading and listening to different strategies, and as no surprise, it all comes down to the financials. I am going to break down how to run the numbers on a rental property so that you can be successful. If you would rather listen to this information, I will link the podcast that I used as a resource here.

Click here for podcast resource: The Personal Finance Podcast by Andrew Giancola.

Let’s dig in. Real estate is a phenomenal way to build wealth, but the biggest factor in being successful in real estate is understanding how to run your numbers. By the end of the article, I want you to be able to know exactly how to do this. The first step is to find yourself a good real estate agent. For more information on how to pick your real estate agent click here. Next, you’ll want to do a deep dive on your finances and pick a dedicated loan officer to service your loan if you are planning on financing this purchase. If you are paying with cash, then skip this step. Learn more about what you need to qualify for a loan by clicking here.

Finding the right deal is paramount to your success when investing in rental properties. Be sure to shop around and see what is out there before buying the first property you look at. You are probably going to submit 50 plus offers before you find the one that works. That’s okay! Rejection is going to be part of the game. Don’t be afraid to submit a low-ball offer if you know that is what you need for the investment property to be successful. Create a plan and stick to your guns. This should not discourage you and you should continue to submit offers because eventually you will find the deal that gets accepted. That is what makes it all worth it. If you are trying to build a real estate rental portfolio, you are going to be running your numbers on properties every single day. Currently, the market is super-hot, which means there are not a lot of properties on the market that make sense as a rental. Get a system in place and work that system everyday so that you are prepared to make an offer.

First rule of investing in real estate, you make all your money when you buy the property. You should determine your odds of profitability before you put an offer in on a property. Profitability is not determined when you start managing it. The purchase price of the asset is the single most important factor in the transaction. If you can buy the property for the right price, the first time, then it becomes very hard to fail. That is why you must run your numbers. Every single deal can make sense at the right price. Even if the property is falling to the ground and needs a complete renovation, at the right price, it can make you a profit. The key to real estate investing is to not over-pay. Even if you are desperate to get your hands on your first property, do not overpay. If you do, you are going to be behind before you can get started.

Here is what we are going to cover:

- How to calculate income

- How to calculate property expenses

- How to calculate a property's cash flow

- How to find a good deal

How to Calculate Income

This is the simplest part for most people to understand. The mistake here is some people only think about this side of the equation and they forget about the next few topics we will discuss later on.

You generate income in several different ways:

- Rental income: standard collection of rent every month from tenants.

- Storage: if you have additional storage units on the properties or vacant garages you can charge people each month to store personal property.

- Laundry: if you have a localized laundry area you can charge tenants per laundry load.

- Covered parking: for tenants RVs, boats, other recreational equipment, etc.

- Additional parking spots: you can charge your tenants for monthly assigned parking in the driveway or garage.

- Late payment fees: you can charge your tenants for not paying their rent on time to incentivize early or automated payments.

The first thing you want to do when calculating your rental value is to total up your income. If it doesn’t meet either of the two basic rules as I will discuss below, then you do not want to continue analyzing the property.

Two rules:

- The 2% rule: Ideally, you will want to use this rule. In today’s market, it is very hard to find (if not impossible). You want to produce 2% of the purchase price in rent every single month. Example: if you purchase a property for $100,000, you want to generate $2,000 a month in rent. The current market makes this property very difficult to find, at the bare minimum you want to use the next rule.

- The 1% rule: Until we see real estate prices shift, you can use this rule in place of the 2% rule. You can still realize a profit under this rule. You want to produce 1% of the purchase price in rent every single month. Example: If you purchase the property for $100,000, you want to generate $1,000 a month in rent. If you can’t hit this threshold, the odds are very high that you don’t have a property that makes financial sense.

This is quick and easy math that you can do in your head. This will help you make quick decisions to decide which property you are going to be analyzing that day. If it does not meet either of these rules, throw it out and move on.

How to Calculate Property Expenses

This is the most important part when analyzing rental properties. This is where people will typically lose money. Generally, operating expenses are usually between 50-60% of the rent, not including capital reserves or the mortgage payment.

Here are common operating expenses that you should factor in:

- Taxes: How do you find out how much your taxes are on a property? Go to your local county auditor or property value administrator’s website, type in the property address, and the annual tax history and tax rate will come up. Remember, property taxes are based off the value of the property, which is usually derived from the most recent sale. So, your property tax will likely be based off the price you purchase the property, which could be more than was paid in the past if the property was valued lower.

- Insurance: Every single rental property should be insured. You need to have an insurance agent on your team that can help get insurance and give you local prices before you purchase.

- Water & Sewer: You want to consider if you must pay for water and sewage for this property. However, it is common to shift this cost to your tenants and make them pay the water and sewer bill. If you are looking at a multi-family unit and the water and sewer is not separately metered, then you will most likely oversee this expense, but it can still be passed through to the tenant.

- Garbage: You need to call the local garbage company or city to find out what the cost is for garbage pickup.

- Electric: As with all utilities, if you are looking at a multi-family unit and they are not separately metered, then you will most likely oversee this expense, but it can still be passed through to the tenant. You will still need to determine the annual and monthly cost.

- Gas: This goes the same as the other utilities.

- HOA: These fees can kill a deal if they are too high. The rule of thumb is to avoid HOAs entirely for rentals because there are too many external factors that can affect the profitability of the deal.

- Lawncare or Snow Plowing: You can put in the lease that your tenants take care of this. But if you have multiple units, then you are probably going to have to take care of this yourself or hire a company to do it for you.

- Repairs: These are normalized repairs like a leaky sink or a broken water heater. You need to factor 8-10% of rental income for small repairs throughout the year.

- Property Management: If you plan on managing the property yourself, I still recommend that you factor in property management. Why? Because life changes. You may not want to manage these properties anymore. Factoring this expense upfront allows you that flexibility to hire a property manager down the line. If you want to know how much property management costs, you will want to look in your local area because rates are localized. Call a couple property management companies near you and factor in that number. It usually between 8-12% of the rental income.

Additional expenses important for calculating cash flow:

- Capital Expenditures: These are the big-ticket items that need to be replaced on your rental property. Capital expenditures include replacing the roof, HVAC system, or new flooring. If you are planning on holding these rental properties for 10+ years, then you are eventually going to have to replace things. You need to factor in 10% of your rental income for this expense.

- Vacancy: This is the amount of time it takes you to find another tenant once your tenant leaves. Vacancy is also known as your “turnover time.” I would factor in 8% of the monthly income for vacancy. This ensures you have a savings account to pay the bills while you are looking for another tenant.

- Mortgage: If you get a loan on the property, you will need to calculate the cost of your mortgage.

- Other Loans: If you used a hard money loan or a bank loan to fund the repairs or renovations on the property, you will need to calculate that as an expense.

Take all these expenses and total them up for the property. These amount to your estimated monthly and annual expenses.

How to Calculate a Property’s Cash Flow

Let’s figure out how to calculate your cash flow. You want your cash flow to be positive and high. A positive cash flow is when you bring in more income than expenses for a given month or year. A negative cash flow is exactly the opposite. Let’s learn a bit more so you can try to stay on the positive side of things.

You can determine cash flow by following these three simple steps:

- Calculate the Gross Cash Flow: You do this by adding up all the rents and other income the property generates that were discussed above.

- Subtract all Operating Expenses and Capital Expense Account Contributions: Think property taxes, fixing a broken toilet, etc. Capital expense account contributions are monies stored in a separate account that provide a safety net for the property owner to use in case of needing a major repair such as a roof replacement.

- Subtract the Mortgage Payment. Mortgage payments, both principal and interest, are not considered operating expenses when determining a property’s value using the capitalization method. But they are extremely important to understand if you are trying to determine your cash flow.

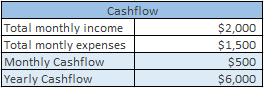

Simply put, net cash flow equals the total income the property produces minus all the expenses, including capital reserve payments and debt service. What is left over is your cash flow, for better or worse. When deciding to invest in a property, you will want to calculate an estimated monthly and yearly cash flow. To project your estimated yearly cash flow, multiple your estimated monthly cash flow by 12. With the tools we just laid out, you should be well on your way. Here is a basic example:

Understanding your cash flow will help you understand whether you are making a good investment and, ultimately, able to make a decent return on your hard-earned money. No one wants to invest a substantial amount of money and time into a property and get an even or negative return. Why? Because you could passively invest your money in an index fund, which historically returns 6-8.5% annually. People invest in real estate for more control over their investment and for higher returns. That is what makes all this work and effort worth it.

How to Find a Good Deal

Now let’s dive into how to use the net cash flow figure to find a good deal that provides a return. You can use the estimated net cash flow to locate a deal using a Return on Investment (ROI) Calculation or a Cash-On-Cash Analysis.

Return on Investment Calculation:

Your ROI will show how profitably your investment capital is being used. The way to calculate ROI is to compare your net profit to the total cost of the property. This is done by dividing the property’s annual net cash flow by the property’s cost.

Let’s take a look at an example:

ROI = Annual Net Cash Flow / Property Cost

$25,000 Annual Net Cash Flow / $195,000 Property Cost = .1282 or 12.82% ROI

In today’s market, investors are usually happy with anything that’s above an 8.5% ROI. So, the example would be a great deal. Run the numbers on the property you plan to purchase and make sure you stay in an ROI zone the provides an ROI above a potentially safer, more passive investment vehicle like the index funds mentioned above.

Cash-On-Cash Analysis:

The second way to determine if you are about to land a lucrative deal is doing a Cash-On-Cash Analysis. This is the return on the money that you put into the deal upfront. You find this by dividing the annual net cash flow by the amount of cash invested in the property. This can be an important analysis when you are purchasing a property you plan to improve and add value to after you purchase it.

To figure out how much was invested you need to add up the following:

- Down Payment: This will be a percentage of the property’s purchase price. It can vary based on the price of the property and the local real estate market.

- Property Inspections: I would estimate that these would cost on the low end between $500-$600 to the higher end of over $1,000, depending on what is being inspected. If you do a full-blown radon test and environmental inspection, get ready to shell out more money.

- Closing Costs: These are usually around 3% of the purchase price.

- Rehab Costs: As we mentioned before, this analysis helps investors who are trying to buy and improve a property. Because of this, we need to add in any rehabbing or repairs you plan to do to the property.

Let’s take a look at the formula:

Cash Invested = Down Payment + Property Inspections + Closing Costs + Rehab Costs + Anything Else Spent to Purchase the Property

Cash-On-Cash = Net Cash Flow / Cash Invested

An Example Property:

It requires a $5,000 Down Payment + $500 Inspections + $1,000 Closing Costs + $1,000 Repairs + $20 Extra Spent = $7,520 Cash Invested

The example property is estimated to generate $6,000 of Annual Net Cash Flow.

$6,000 / $7,520 = 0.798 or 7.98% Cash-On-Cash Return.

Each investor is different when it comes to what is an acceptable Cash-On-Cash Return. The same goes for the ROI analysis. As a general rule, most experts agree that investors analyzing properties using the Cash-On-Cash method will look for a return somewhere between 8-12%. The example would be close, but there may be something better out there.

Now you know the basics. While it might seem daunting at first, if you stick to these principles and do your research, you can find a real estate deal out there that will make you money. Being patient and principled will help you avoid purchasing a property with a subpar ROI or Cash-On-Cash return.

About the Author

Recent Posts

Let's Stay Connected

Want to join the prec community?

Join our mailing list!

All Rights Reserved | Perry Real Estate College | Site by Fix8