Bonnie is licensed in both Ohio and Kentucky, specializing in residential, commercial, estate sales, and investment portfolios. Bonnie won the Best Of Zillow award for her customer reviews and sales in 2020. She also won Rookie Of The Year and Top Earner award for Ken Perry Realty in 2020. She is a proud member of the Cincinnati Area Board of Realtors Arbitration and Grievance Committee.

How Long Will It Take Me To Find a House?

In today’s unprecedented market, finding a home may seem to be a daunting task. Just a couple of years ago, mortgage interest rates were at record lows and so was housing inventory.

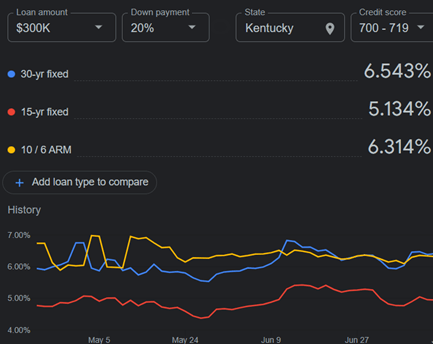

In fact, Realtor.com’s inventory forecast points to a mere 0.03% rise in inventory. Now we are in the same predicament of low housing stock, but mortgage rates give us an entirely new picture of the financial climate. A quick Googling of today’s mortgage rates shows staggering new heights.

If the buyer is preapproved and prepared to pay prevailing rates on a home, just how long should they expect to be looking before they find “the one?” Once upon a time, I had a client who fell in love with the first home they laid their eyes on. To my disbelief and an itinerary filled with other homes to view, they were smitten with the first home they toured. They were willing to go to whatever lengths required to beat out any competing offers to win the bidding wars for their dream home. Cases like this are few and far between. Caveat emptor is in effect as buyers are taking heed of being at the mercy of sellers. Sellers who saw their neighbors’ houses sell for significantly over the asking price are in for a rude awakening. Buyers are not as willing to succumb to their demands as interest rates climb steadily higher. However, word to the wise for buyers: prices do not seem to be on the downturn either.

So, what does this mean for finding a home in these extenuating circumstances? On average it takes buyers four weeks to buy a home per Trulia’s metrics. Zillow research reveals that 13% of homebuyers took anywhere between seven months to a full year. Certain factors come into play…

TIMING

Does the buyer have to find housing due to a job relocation, kids going to a new school, or a similar situation? When under time constraints such as these, buyers may be willing to sacrifice finding a home that checks every box on their list to settle into a new home that meets most of their needs.

BUDGET

The individual budget of each buyer will be tested in this survival of the fittest type of housing market. Most buyers are diligent with sticking with set amounts for their desired monthly mortgage payment. They also have to take into account, closing costs, earnest money, and an added cushion for incidentals to name a few. While some buyers are willing to pay upwards of $50k or more over asking, waive inspections, and even bridge the appraisal gap, many buyers are not willing to compromise their financial livelihood to win their dream home.

NEEDS v WANTS

It’s crucial to be realistic about what you need in a home (e.g., 2 bedrooms), versus what you would like to have, say a third bedroom or den for your home office. It would be nice to have a big yard for Fido, but a smaller yard could suffice. A garage would be great, but off-street parking could work too. An old-fashioned pros vs cons list will help refine your search and home in on what may be a perfect fit, pun thoroughly intended.

Whether you are just beginning the homebuying journey or have been looking for several months, patience is a virtue in this market. If you are working with a reputable lender and an experienced agent, you are in capable hands to find a great home, even in the complexities of today’s real estate market.

About the Author

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market