Gabbi knew that real estate was the right career from the start. She is now dual licensed in both Kentucky and Ohio. She had her first sale within a month of getting licensed and hit her first million in sales volume within her first 6 months. She will have her real estate license for the rest of her life. Call her anytime if you have questions about becoming a real estate agent. She loves to share her passion for real estate with others!

Different Price Points and Savings Goals for Homebuyers

I am a real estate agent in Cincinnati Ohio and Northern Kentucky. I bought my first place, a condo, in January of 2021. I was able to buy my place when the interest rates were below 3% so my cost of living right now is comparatively low. Within the next year or so, my goal is to buy another house with a garage and rent out my condo, where I live in now.

It’s now December of 2022, interest rates have risen considerably. What does that mean for consumers? Well, for sellers it means pricing your house correctly, the first time, is more important than ever. There is less demand now than in the past two years and if you want your house to move then you must price it competitively. You don’t want to overprice it because you don’t have the inflated demand to make up the difference. If you overprice it now, your house could be sitting on the market for longer than you expected. This leads to speculation about the house itself, which ultimately deters buyers. You also don’t want to underprice it either because you could be leaving money on the table.

What does this mean for buyers? It means that there is a window of opportunity to purchase a home at a fair price, maybe even lower than market value, and possibly have closing costs paid for as well. You are paying a higher interest rate but buyers now have the upper hand. This means that they can use whichever loan products is best for them and have full inspections. This may seem like I am describing a normal transaction, but these terms were not an option in the heat of the seller’s market last year. When submitting a purchase contract against 10 other offers, you often had to use cash or a conventional loan to get it accepted and possibly waive your inspection so that you could end up winning the house. Now, I am seeing inspections go through and the seller is a lot more willing to make repairs, reduce price, or issue a credit because they don’t have the demand of other buyers to fall back on. In the previous seller’s market, sellers were less likely to make repairs because if they could not come to an agreement with the current buyers they could terminate the contract and offer the house to one of the other original offers.

Why are we going over all this? Well, now that it’s been 2 years since I bought my condo, I am starting to look at homes and trying to consider what I can afford now. It’s a different market and I am now looking at houses in a higher price range than my current place. Since I’m already doing this for myself, I thought I’d share my process for determining how much I need to save for my next purchase. Let’s dive into the standard costs associated with a typical purchase transaction.

Costs associated with every transaction:

- Down Payment- Your down payment can be anywhere from 3.5%-20% of the purchase price. This is determined by what loan product you choose and by what financially puts you in the best position. I put 6% down as my down payment in the first place I purchased but it’s completely fine to put 3.5% depending on the loan product you go with. This time around I am aiming to put a considerably larger down payment only because interest rates have risen, and I’ll want to lower my monthly payment as much as possible.

- Earnest Money (Refundable)- Once your contract is accepted you will need around $1000-$1500 to put down as earnest money. Earnest money is "good faith money" or another way of ensuring the seller that you are serious about this transaction. If you terminate the contract, you get this money back, and if you complete the transaction it will go toward your down payment. (I won’t be including this in my calculations below because you can use this amount as part of your down payment, but you must have this cash on hand when you submit a contract, so I wanted to mention it so that you can be aware of it.)

- Closing Costs- Closing costs vary by transaction but they are usually between $2500-$3200 or roughly 3% of the purchase price. You’ll work closely with your loan officer to find out what your exact closing costs are once you are under contract, and you know the purchase price. (In this market, it’s a buyers’ market, it’s very likely that you might be able to get the seller to pay for your closing costs. So, plan for this expense but you could possibly not have to worry about it.)

- Inspection Cost- A standard inspection is around $500-$600 but if you need specific follow up inspections (like a termite inspection, plumber, electrician, or structural engineer) then it’s an add on. Each additional specific inspection can vary between $100-400.

- Appraisal Costs- Your loan officer will charge you for an appraisal of the house, it’s usually between $300-$350.

In conclusion, besides your down payment your standard estimated costs for purchasing a house include:

- Closing costs: $2800

- Inspection cost: $600

- Appraisal costs: $350

Total Costs: $3750.00 ($950 if your closing costs are covered by the seller.)

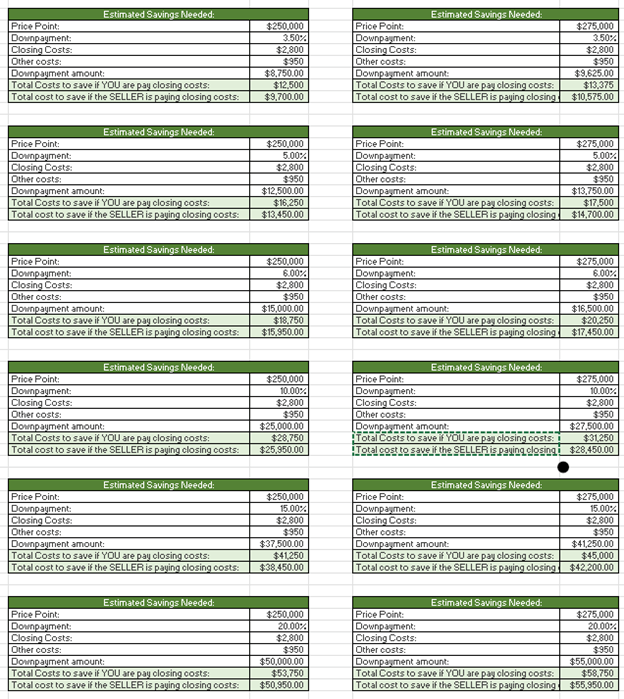

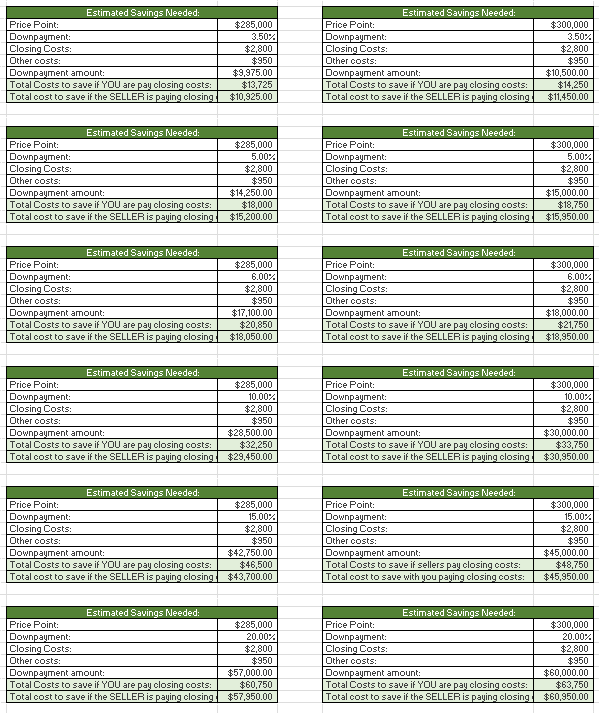

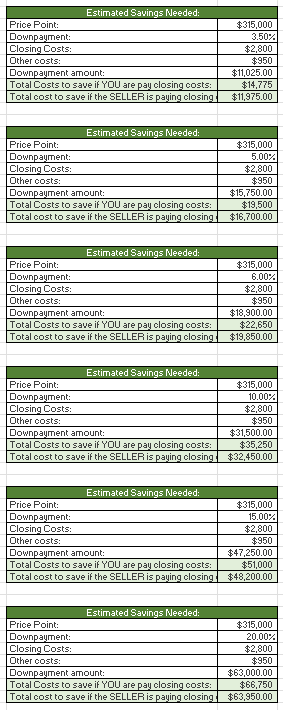

The areas I am interested in looking include Northern Kentucky and areas near East Walnut Hills. I am going to keep my price range around $250,000-$315,000 if I want to be able to put down a strong down payment. Now, if I wait another year or so, I will be able to save more cash and increase my purchase price amount. Below I am going to map out the estimated savings I will need at each price point.

Each of my estimates below will include the following figures:

- Price Point: The purchase price.

- Down Payment Percentage: The percent of the purchase price I am putting down.

- Closing Costs: For this example, I am estimating my closing costs to be at $2800 but they could be higher or lower depending on the transaction.

- Other Costs: This includes my inspection and appraisal costs.

- Down Payment Amount: This will be calculated using the down payment percentage and the price point amount that I mentioned above.

- Total Costs to Save: This is my total amount of cash that I would need to bring to closing if I am paying for closing costs.

- Total Costs to Save (without closing costs): This is my total amount of cash that I would need to bring to closing if the seller was paying for my closing costs.

Estimated saving you will need at different price points and different down payment amounts:

I hope this helped you map out your future savings for your next purchase. Remember that these are estimates and ideally, you will want to save an additional "cushion" to cover unexpected costs. You'll also want to save money for additional repairs after closing, renovations or upgrades, furnishings, and movers. Let us know if you have any questions and look back to the Career Corner on more tips for buying a house!

About the Author

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market