Gabbi knew that real estate was the right career from the start. She is now dual licensed in both Kentucky and Ohio. She had her first sale within a month of getting licensed and hit her first million in sales volume within her first 6 months. She will have her real estate license for the rest of her life. Call her anytime if you have questions about becoming a real estate agent. She loves to share her passion for real estate with others!

An In-depth Look at How Credit History Impacts Your Client's Real Estate Buying Power

Credit can be a sensitive topic for people because it can either be a direct indication of peoples’ financial failures or it can be an indication of their commitment to their financial success. Either way, as a real estate agent, your client’s credit score matters. It is a crucial part of the home buying process that influences your client's position when obtaining a mortgage loan.

Credit needs to be a point conversation with any new client you take on, even if your client is already matched with a lender and has already obtained their pre-approval letter. The reason being is part of your position as a real estate agent is to educate your client and make sure that they are in the strongest position possible when entering the process of buying a house. Unless their credit score falls under the “great credit” category (see below) then there are always small adjustments that can be made that will strengthen their score so that they can either lower their interest rate or increase their buying power. No matter what their age, goals, or previous home-buying history, you must take a minute to have a conversation about their credit score. If you ever come across a client that isn’t comfortable talking about their credit history with you, connect them with a lender that they can trust and let them have those conversations and respect their privacy.

The first thing you should do when approaching the topic of credit with a new client is to simply discuss the importance of credit within real estate transaction. The objective here is make sure your client is aware of what their credit situation is and that they immediately begin building and/or strengthening their credit score if necessary. Credit greatly impacts a person’s position in obtaining a mortgage loan. It is a key factor in deciding what interest rate will be applied to the lifetime of their loan (which could cost a person thousands of dollars), it determines what loan products they could be eligible for, and it helps determine the amount of money the lender can approve them for.

Credit is not an immediate fix; it takes time to build and strengthen a credit score. Be patient and have realistic timelines for your client to look forward to. If you are not super well versed in how credit works, the first thing I would recommend is to try and learn as much as possible! Read books, listen to podcasts, and meet with people who have extensive knowledge of how to influence a credit score. The second thing I would recommend is forming a working relationship with a mortgage lender that you know has experience with helping clients transform their credit history. Then they can operate as an additional resource for your client. The main focus is to have your client be aware of their credit history right off the bat so that they can get on the right track as soon as possible.

Different Credit Situations:

No credit (Credit score of 0-299): If your client is young or has always operated day to day with cash or a debit card, the first step would be for them to go to their local bank provider and open a credit card. If your client has never had a credit card, then they will not have any credit and will need to start building it as soon as possible. This will take time, but there is a right and a wrong way to start their credit-building journey. Here’s an article that you can share with your client that explains the correct steps a person should take when first establishing credit. Remember to remind your client that this is a process, just like anything else, it takes time to establish positive financial habits, but it is worth it. They will thank their future-self for taking the time to learn how credit works and how it can positively impact their future financial decisions.

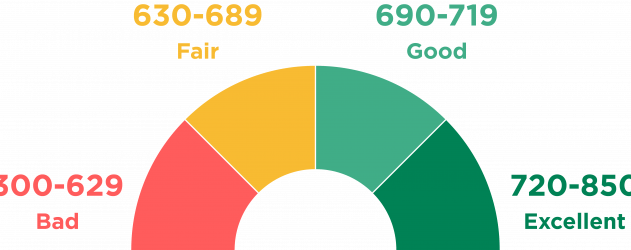

Bad Credit (Credit score of 300-629): People can obtain a "bad" credit score for so many different reasons. Your client could have opened a credit card and forgot to pay it off. They could have fallen into financial hardship and used credit cards to get by. They could be maxing out their credit cards each month and only making the minimum payments month after month. There are millions of other little credit mistakes that people are simply unaware of that could be adding up over the years and significantly impacting their credit score. The first step in remedying this situation is to learn what has been negatively impacting their score and educate them or provide resources on how they can prevent and change these behaviors in the future. Click here for an online article that is a great resource to send to a client that outlines how they can begin to improve their credit score.

Good Credit (Credit score of 630-719): If your new client falls under the “good" credit group then you are already off to a great start. A person with a “good” credit score is already telling us that they pay their credit card bills on time. Furthermore, it could possibly indicate that they are in a financially sound position. Operating within a strong financial position is going to enable your buyer to potentially obtain a pre-approval letter from a mortgage lender, which allows them to move forward in the homebuying process. I would recommend that you send them this article that goes over how they can make small changes to push their credit score from “good” to “great.” It may seem like they are already set but dedicating some time to narrow down what is hurting their credit score could allow them to have access to all the benefits of having a “great” credit score. Which ultimately means, they are going to be able to save themselves time and money in the long run.

Great Credit (Credit Score of 720-850):

Terrific! Your client is starting out in the strongest position possible to obtain a mortgage loan. They can explore the benefits of possibly obtaining a lower interest rate, gaining access to more loan products that might better fit their needs, and possibly increasing their buying power with a larger approved loan amount. Congratulate them on a job well done and tell them to keep doing what they are doing.

Credit can be a tricky topic to navigate but you are not properly preparing and educating your clients without touching on the impacts credit has on their buying position. Remember, if you ever come across a client that isn’t comfortable talking about their credit history with you, connect them with a trusted lender and let them have those conversations. If they are not open to discussing their credit history with anyone, including the lender, then that might be a sign that they are not ready to buy a home just yet, which is completely okay. Remind your client that there are resources out there that were created to help people positively influence their credit history. Life happens and that’s okay! There will come a time when they’ll have amended their previous credit mistakes and will become elidable for mortgage loan. If you are working with a client that is actively trying to build or strengthen their credit, be sure to check in with them every couple of months to see how everything is going. Keep checking back to the Career Corner for more ways to navigate becoming a successful real estate agent. If you have any questions about anything in this article, feel free to reach me at my email: gabrielle@perryrealestatecollege.com. Good luck!

About the Author

Recent Posts

Let's Stay Connected

Want to join the prec community?

Join our mailing list!

All Rights Reserved | Perry Real Estate College | Site by Fix8