Gabbi knew that real estate was the right career from the start. She is now dual licensed in both Kentucky and Ohio. She had her first sale within a month of getting licensed and hit her first million in volume within her first 6 months. She will have her real estate license for the rest of her life. Call her anytime if you have questions about becoming a real estate agent. She loves to share her passion for real estate with others!

Quick Market Update: Inflation 2022

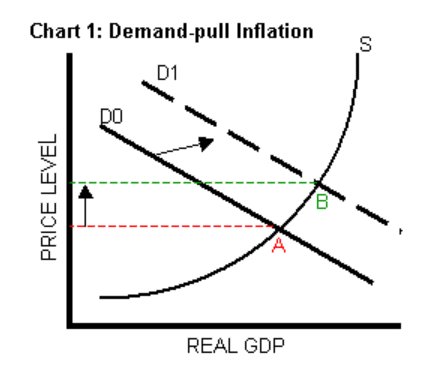

Inflation basically means prices are rising. This year we’ve seen and felt the prices of goods and services rise by about 8.3% according to the Consumer Price Index (CPI). Before we dig into what’s going on in today’s market let’s go over how inflation happens.

Basic factors that contribute to inflation:

- Increase in the money supply

- Worker shortages

- Rising wages

- Supply chain disruption

- Fossil fuel policies

Goods and services affected by inflation:

- Housing

- Apparel

- Food

- Transportation

- Fuel

Please note that if the prices of just a few types of goods and services are rising then there isn’t necessarily inflation.

Ways inflation can be measured:

- Gross Domestic Deflator (GDP Deflator)

- Consumer Price Index (CPI)

- Bureau of Labor Statistics (BLS)

- Personal Consumption Expenditure Chain Price Index (PCE Price Index)

When we are measuring inflation, we are comparing this year’s prices to the one before. Last year, was when we started to see inflation really kick up. Right now, experts are saying that we are at a plateau. The numbers aren’t climbing but they are also not moving toward more normal levels. This year we have seen extremes in the prices of homes and oil. Russia’s invasion of Ukraine in February helped to drive a spike in crude prices that took oil to nearly $140 a barrel at one point.

How is inflation directly affecting the housing market?

Simply put we do not have enough inventory to keep up with the demand. Covid put a sense of urgency on people to secure long-term housing, especially because working from home is at least partially sticking around if not the norm. This means people want to own their spaces in this new era. This in combination with all-time lows in interest rates has made the housing market blow up. The increase in prices year over year is shocking. Interest rates are beginning to climb but we are not seeing an increase in inventory.

My advice? If you are looking for a home right now don’t be discouraged. Find a realtor that you can trust and someone who has time for you. Finding a house in this market is not easy. You are going to put in offers that will not get accepted. The best way to go is to save up for 20% down so that you can go with a conventional loan over a FHA loan so you have a stronger offer. Then I would be looking at houses right under your price range. That way you can still be super competitive (if you love the house) in a multiple offer situation. Find an amazing loan officer and make sure that he picks up the phone when you quickly need a pre-approval letter.

We hope you learned something from this quick market update. Check back next month to see where this wild ride takes us as we move through 2022.

About the Author

Recent Posts

Let's Stay Connected

Want to join the prec community?

Join our mailing list!

All Rights Reserved | Perry Real Estate College | Site by Fix8