Gabbi knew that real estate was the right career from the start. She is now dual licensed in both Kentucky and Ohio. She had her first sale within a month of getting licensed and hit her first million in volume within her first 6 months. She will have her real estate license for the rest of her life. Call her anytime if you have questions about becoming a real estate agent. She loves to share her passion for real estate with others!

Standard Real Estate Agent Tax Write-offs

As an initial matter, the following is not intended to serve as tax, legal, or financial advice. Tax laws can change, and this blog may contain information that could be outdated. For any tax related issues, you should seek the help of a licensed professional. This overview is simply illustrative of potential tax deductions for educational purposes only.

Filing your taxes as a standard W-2 employee can get complicated. Filing your taxes as an independent contractor can be even more complicated. Generally, real estate agents are 1099 independent contractors. That’s why we are going to walk through the top 16 tax deductions every real estate agent should know.

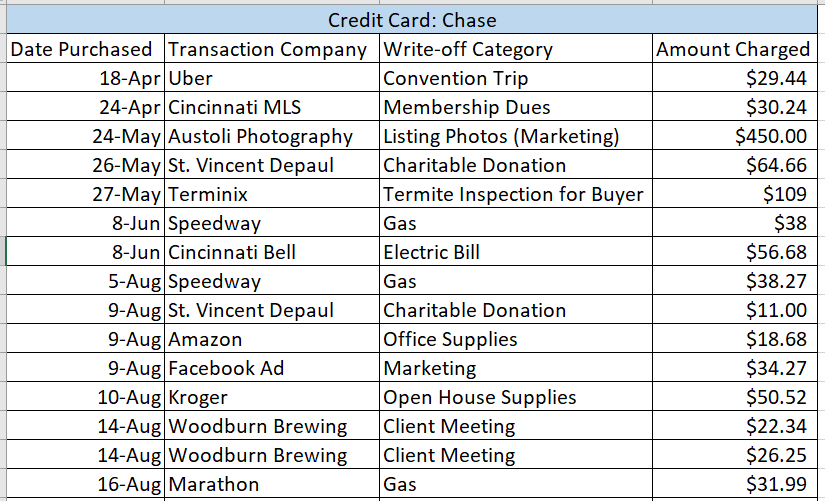

Why are these important to know? Because if you keep track of all your expenses throughout the year it is going to make filing your taxes a lot easier. A great way to keep organized is to have a separate credit card for business expenses. This will make keeping your spending and your business spending separate. Another great way to keep track of your business expenses is to create a tracking sheet with five separate columns.

The Five columns you should track are:

- The credit card that was used.

- The date purchased.

- Where the transaction occurred.

- The correct business write-off category the item falls into.

- The amount spent.

Please review the sample worksheet below.

Now let’s discuss the 16 tax deductions for real estate agents.

1.) Commissions Paid. Commission paid by your business to other agents includes referrals and third-party lead generations systems.

2.) Standard Auto Deduction. If you use your vehicle for your business, you can deduct a portion of some gas mileage, maintenance, and repair costs.

3.) Legal & Professional Services. If you use an attorney to draft up a lease agreement or other legal or professional fees you can deduct this expense if it’s considered a necessary, part of your operation.

4.) Advertising Expense. The IRS allows you to deduct a reasonable amount of expenses that are directly related to your marketing. This can include printed media, mailers, and design work for your business.

5.) Home office Deduction. If you use your home as an office, you can deduct a portion of your monthly expenses. To qualify for this write-off, you need a separate room in your home that you use exclusively for business.

6.) Charitable Deduction. Generally, charitable deductions are limited to 50% of your AGI (Adjusted Gross Income), however, if you are donating capital gain property or donating to certain types of organizations, you can be limited to 20-30% of your AGI.

7.) Self-Employment Tax. If your net earnings from self-employment are $400 or more, the IRS requires that you also pay self-employment tax, which is the Social Security and Medicare that would be withheld from your pay if you were a W-2 worker. You can deduct a portion of this tax when you file your tax return at the end of the year.

8.) Business Entertainment. If you are taking clients out to dinner or drinks to build relationships, then you can use 50% of the expense as a business write-off in certain, limited situations.

9.) Conventions, Seminars, & Tradeshows. If you are going to any of these kinds of events to promote your business, then you can deduct your travel and admission expense.

10.) Educations & Training. If you take classes or training courses to further your professional education you may be eligible to deduct your tuition, related course materials, and certain travel costs.

11.) Office Rent. Office space can be a very expensive overhead cost. If you rent a space in a commercial building, then you can deduct it as part of your business operations.

12.) Member Dues. You cannot successfully perform your job as an agent without being a member of certain local organizations that have listings or other applications. These dues are a business write-off.

13.) Office Expenses. This can include furniture, postage, printing, any other tools that are necessary to run your office.

14.) Tax Preparation Fees. Preparing your tax return is not easy, it’s best if you hire a professional accountant and you can write off that bill as well!

15.) Closing Gifts. You are allowed to write off $100 per client as a closing gift. However, this can very by state.

16.) Self-Employed Insurance Deductions. Being self-employed has its perks but it also comes with additional responsibility, including healthcare. The health insurances premiums that you pay out of pocket do count as tax-deductible.

Again, this information is provided for informational purposes only and should not be used as legal or financial advice. It is not intended to substitute hiring an accountant or a financial advisor. Remember to do your research, stay organized, and hire a professional. Before you know it, tax season for 2021 will be right around the corner. Stay ahead of the game by checking in on the Career Corner for more articles and agent tips!

About the Author

Recent Posts

Let's Stay Connected

Follow us on and become part of the PREC community

Never miss a tweet by connecting with us on Twitter

Check our our posts about trends in real estate industry and market